Crypto prediction markets didn’t arrive quietly. They crept in through election nights, major sports finals, and sudden geopolitical headlines, then stayed because people kept checking the prices. By 2026, these on-chain markets aren’t side experiments anymore. They’re reference points.

After watching these markets grow across multiple election cycles and sports seasons, one thing stands out: people trust prices more than opinions.

Traders now express conviction by risking capital instead of posting takes. Markets update in real time. Odds shift faster than breaking news alerts. The money trail tells its own story, and it’s hard to ignore.

What started as a DeFi curiosity now functions like a live probability feed for real-world events.

Why Crypto Prediction Markets Matter Now

Prediction markets convert belief into price. That’s the entire appeal.

Each trade nudges a probability up or down. The more capital behind a view, the louder the signal. Unlike polls or commentary, there’s no room to hedge words. You either buy the odds or sell them.

Several changes pushed these platforms into the spotlight after the 2024 election cycle:

-

Anyone can participate without banks or brokers

-

Stablecoins make settlement simple and fast

-

Low-fee blockchains allow constant trading

-

Public trust in forecasts and pundits has eroded

Sports played a major role. Live games generate fast-moving markets with clear outcomes. Politics followed naturally. Macro events filled the gaps in between. Crypto-native price targets tied everything together.

That shift didn’t happen overnight. It built momentum quietly, then felt obvious all at once.

By early 2026, trading on outcomes feels less like wagering and more like consuming alternative data.

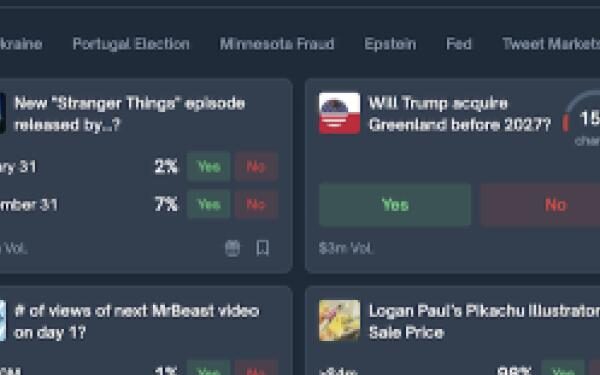

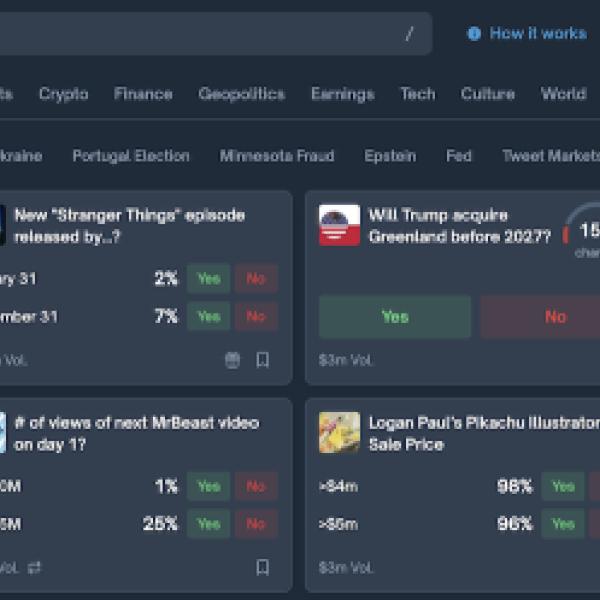

Source: Polymarket

The Top Crypto Prediction Markets Dominating 2026

A small group of platforms now shapes most on-chain forecasting activity. Each attracts a different crowd, but liquidity and speed define the winners.

Polymarket: The Market Leader

Polymarket sits at the center of the conversation. It handles the largest share of decentralized prediction volume and hosts the widest range of markets.

Its interface feels familiar. Anyone who’s used a trading app can jump in quickly. Markets span U.S. elections, global conflicts, major sports leagues, crypto benchmarks, and even things like how many views the next Mr. Beast video will get.

Liquidity is the key advantage. Large positions don’t break pricing. Odds adjust smoothly. Screenshots of shifting probabilities spread fast on X, where traders treat them like breaking signals.

If you’ve ever watched odds move during a live game or breaking news event, you know the feeling. Prices sometimes jump before commentators finish their sentence.

Journalists monitor these prices. Analysts reference them. That visibility brings influence — and scrutiny.

Limitless Exchange: Built for Speed

Limitless gained traction by focusing on execution. Running on Base, it emphasizes live sports and crypto price action.

In-play markets dominate activity. Automated liquidity lets traders enter and exit without waiting. This setup favors momentum traders who react quickly rather than hold positions for weeks.

Azuro: A DeFi-Native Sports Model

Azuro approaches prediction markets as infrastructure. Liquidity providers supply pools and earn yield from betting volume. Oracles handle settlement.

Soccer drives much of its usage, particularly outside the U.S. Many users view Azuro as a yield strategy with a sports overlay rather than a pure betting venue.

Myriad Markets: Aggregation Over Expansion

Myriad doesn’t try to out-list everyone. Instead, it aggregates liquidity across platforms.

Cultural events, award shows, and climate-related outcomes headline its markets. Traders who want exposure beyond daily headlines tend to gravitate here.

PredictBase: AI Meets Social Trading

PredictBase operates at the edge of experimentation. Users can spin up markets from social prompts. AI agents assist with pricing and structure.

Volume remains modest, but attention doesn’t — especially because its AI‑augmented market creation has produced some unconventional outcomes that traders find intriguing. Early adopters treat it as a high‑risk, high‑upside play if AI‑driven markets gain broader acceptance.

How Crypto Prediction Markets Actually Work

Traditional betting asks you to choose a winner. Prediction markets ask you to price uncertainty.

Each event issues outcome tokens, usually “Yes” or “No.” Prices range between $0 and $1. A token trading at $0.65 implies a 65% probability.

Traders buy or sell based on their expectations. If new information emerges, prices adjust immediately.

Stablecoins handle settlement. USDC dominates. Smart contracts hold funds until resolution, then distribute payouts automatically.

Two structures dominate:

Resolution is the critical step. Oracles, official data sources, or predefined rules determine outcomes.

This is where things get messy, and most disagreements start.

Ambiguous wording creates friction. Even clear events can spark disputes if definitions aren’t tight.

Transparency cuts both ways. Every trade remains visible forever. Patterns draw attention. At the same time, open ledgers expose behavior closed systems never reveal.

Why These Markets Attract So Much Attention

Prediction markets reward accuracy. Confidence without capital carries no weight.

Several forces explain their rapid growth:

-

Prices react faster than polls

-

Correct information pays

-

Markets exist for almost any outcome

-

Participation doesn’t require permission

Sports now generate more than half of total volume. Geopolitical tension adds another layer of volatility. Traders react to headlines within minutes.

Some people love that speed. Others find it uncomfortable. Both reactions make sense.

Automation amplifies everything. AI-assisted market creation expands coverage. Faster resolution keeps capital moving.

The Controversies Shaping the Conversation

Growth brings pressure. Prediction markets now face challenges that go beyond technology.

Insider Trading Concerns

Certain geopolitical markets triggered backlash after odds moved before public announcements — most notably around the recent U.S. military raid that captured Venezuelan President Nicolás Maduro in early 2026. In one case, Polymarket refused to settle more than $10.5 million in wagers on whether the U.S. would “invade” Venezuela, saying the specific event did not meet the market’s definition of an invasion, even after the raid and Maduro’s capture.

Critics called the decision arbitrary given the stakes and timing of market movements, and the episode sparked broader debate about access to non‑public information and fairness on these platforms.

Resolution Disputes

Language matters. Terms like “arrest,” “invasion,” or “control” can decide payouts.

Some users accuse platforms of subjective interpretation. Others accept disputes as inevitable growing pains.

Regulatory Pressure

Lawmakers are paying closer attention. Calls for oversight increased as volumes surged.

No one agrees on where the line should be drawn yet.

Ethical Tension

Profiting from conflict unsettles many observers. Traders respond that markets don’t cause events. They measure expectations.

That disagreement isn’t going away.

What the Future Likely Holds

Prediction markets aren’t fading. The signal they produce is too useful.

Several shifts seem likely:

-

Clearer participation rules

-

Improved oracle standards

-

Expanded sports and entertainment coverage

-

Deeper integration with analytics tools

Annual volume could climb again this year. Traditional finance firms are already exploring similar models.

Whether that ends in mainstream acceptance or tighter restrictions is still an open question.

Trust remains the real bottleneck.

Final Take

Crypto prediction markets now sit where finance, media, and public sentiment intersect. Prices often reflect collective judgment before headlines catch up.

That influence explains both their appeal and the controversy around them. These markets don’t promise certainty. They offer probability backed by incentives.

Ignoring them used to be easy. It isn’t anymore.

Frequently Asked Questions

Here are some frequently asked questions about this topic:

What are crypto prediction markets?

Crypto prediction markets are blockchain-based platforms where users trade on the probability of real-world events. Prices represent collective expectations backed by money, not opinions.

How do crypto prediction markets work?

Each event has outcome tokens, usually “Yes” or “No,” priced between $0 and $1. Traders buy or sell based on their view, and prices shift as new information appears.

What is the difference between prediction markets and betting?

Traditional betting offers fixed odds set by a bookmaker. Prediction markets allow users to trade probabilities freely, with prices changing based on supply, demand, and news.

Why are prediction markets popular in 2026?

They’ve grown due to live sports trading, political uncertainty, low blockchain fees, stablecoin settlement, and declining trust in polls and expert forecasts.

Are crypto prediction markets legal?

Legality depends on jurisdiction. Some regions allow them under specific rules, while others restrict or closely monitor activity as volumes and visibility increase.

What risks do prediction markets have?

Key risks include unclear market definitions, resolution disputes, regulatory changes, and uneven access to information, even though all trades are publicly visible on-chain.

If this article, video or photo intrigues any copyright, please indicate it to the author’s email or in the comment box.