La actividad de las ballenas en el mercado de Ethereum ha despertado un renovado entusiasmo entre los inversores. En medio de una recuperación de precios del 7% y un volumen de transacciones que superó los $28 mil millones en 24 horas, el ecosistema de Ethereum parece estar ingresando en una nueva fase de acumulación estratégica. Pero, ¿es esto una señal de un rally mayor o simplemente una corrección temporal dentro de un ciclo bajista más amplio?

TE PUEDE INTERESAR: Inversores institucionales compran la caída de Ethereum mientras el retail vende con pánico

Ethereum supera los $2.400 impulsado por compras institucionales

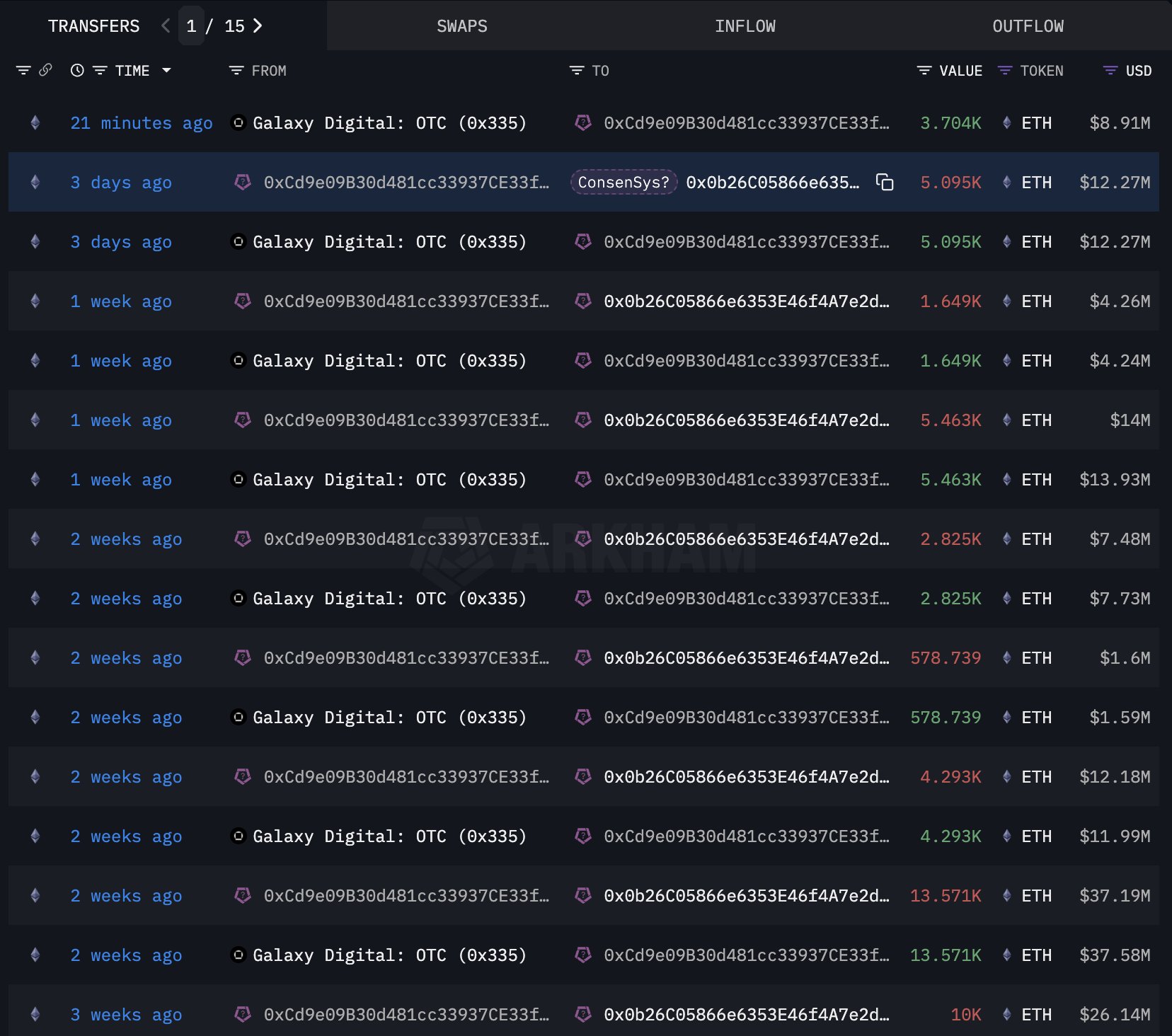

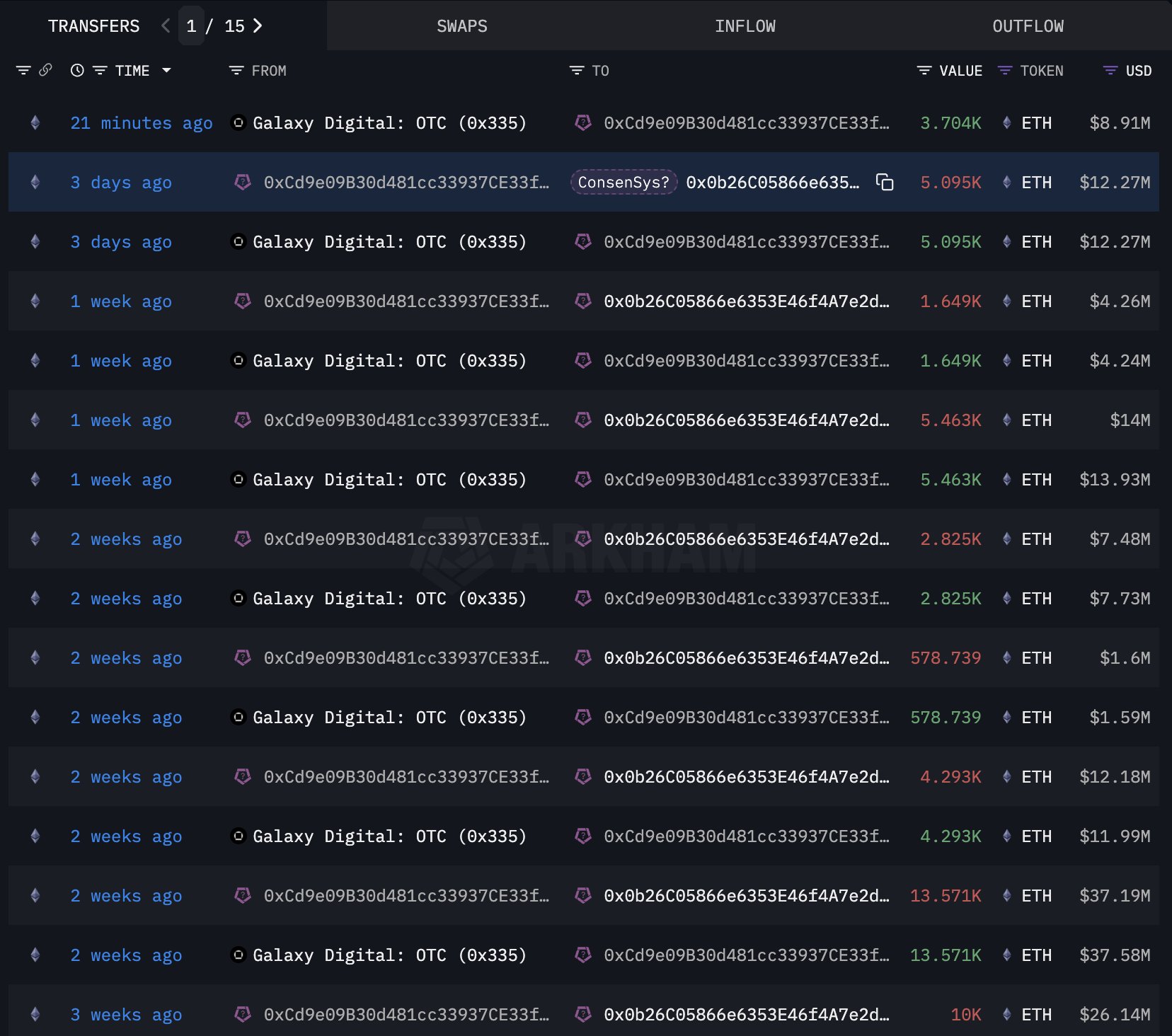

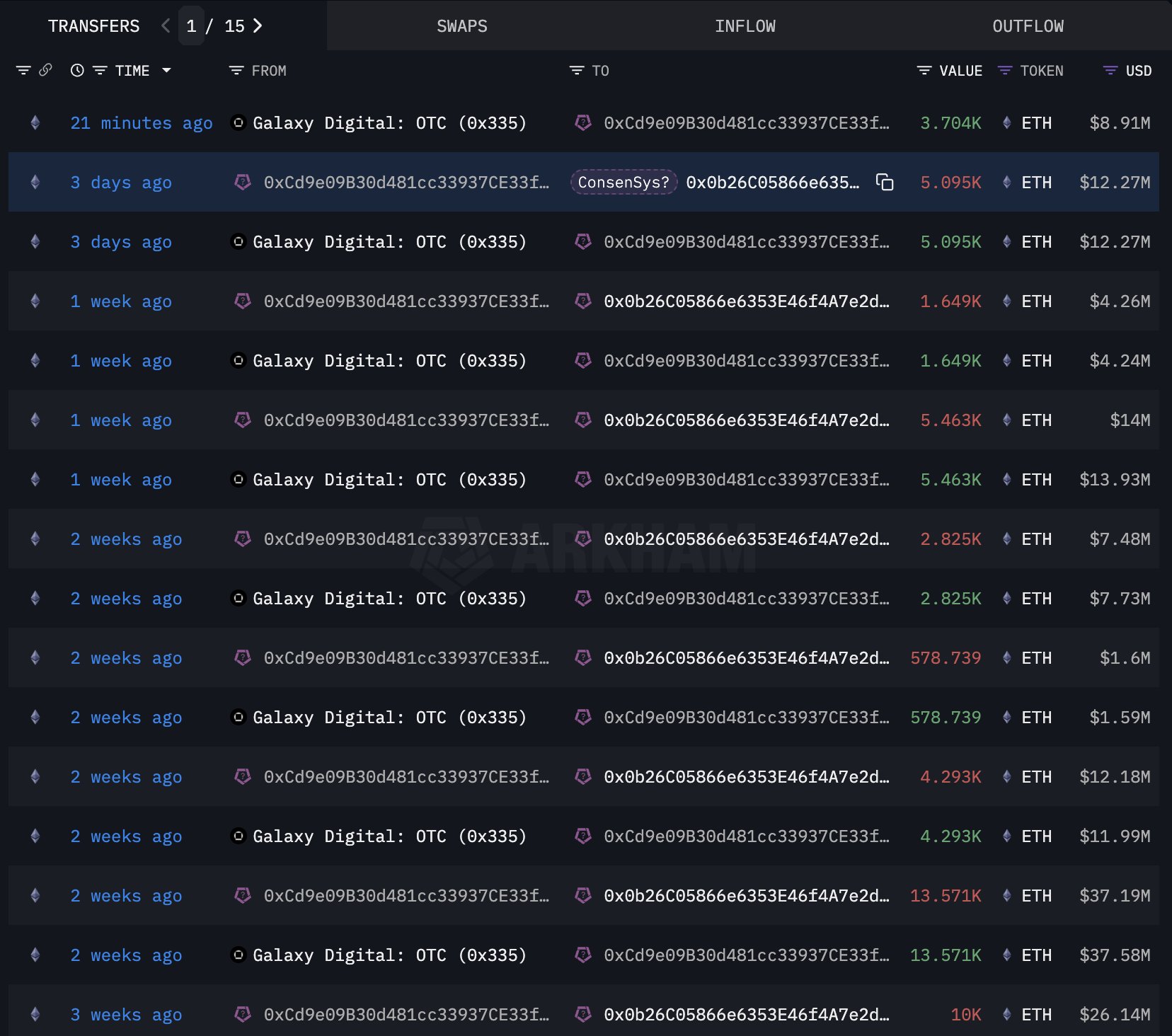

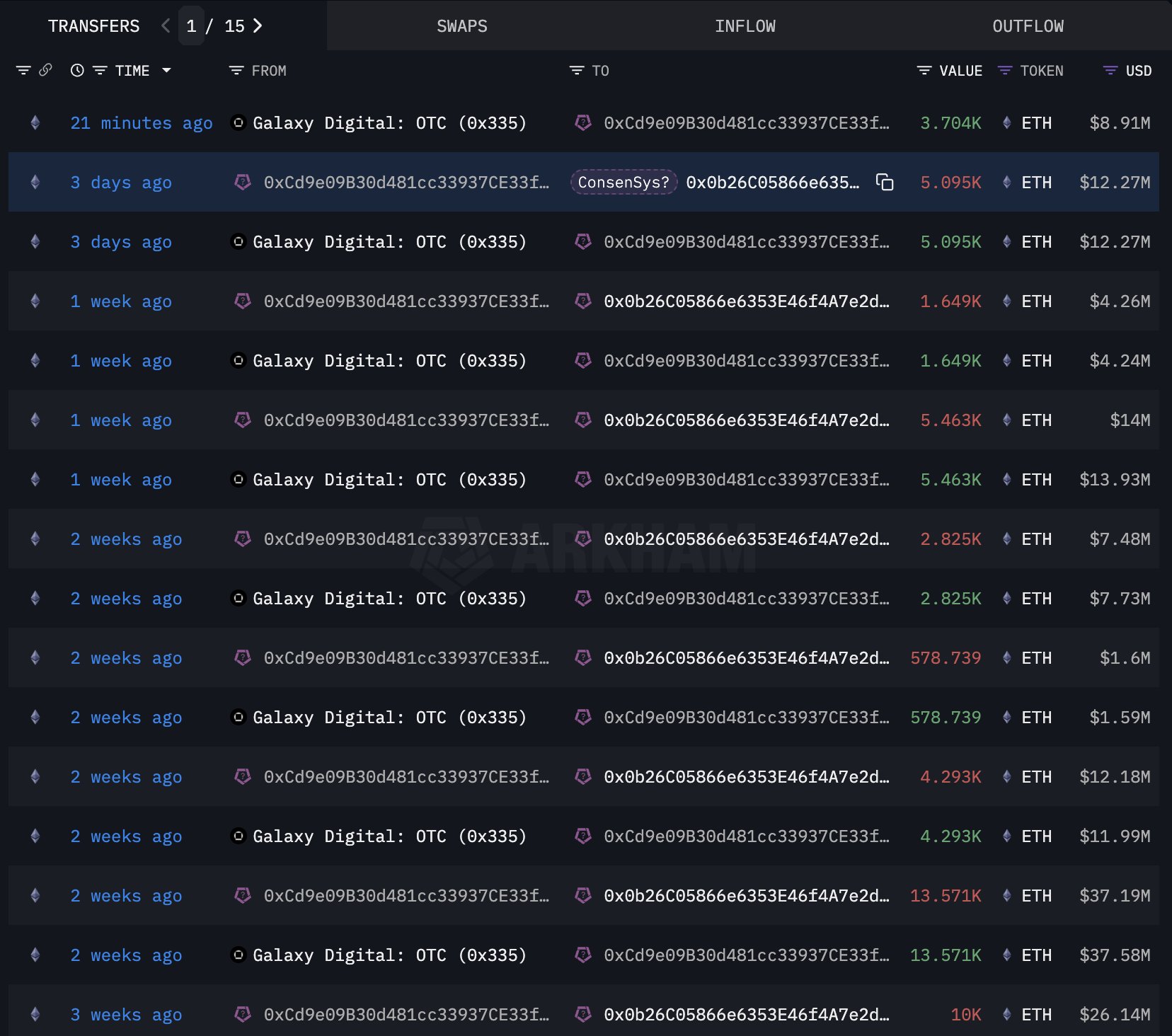

En la última semana, Ethereum ha mostrado signos sólidos de recuperación. Luego de tocar un mínimo de $2,131 el domingo, ETH repuntó con fuerza y alcanzó los $2.409. Esta subida del 7% se produjo en paralelo a una transacción significativa protagonizada por una ballena cripto: la compra de 3.704 ETH, valorados en $8.91 millones, a través de la mesa OTC de Galaxy Digital.

Los datos de LookonChain indican que esta no es una operación aislada. La misma entidad ha acumulado 161.112 ETH (más de $422 millones) en solo tres semanas. Este nivel de acumulación masiva por parte de una posible institución vinculada a ConsenSys está generando expectativas alcistas en el mercado.

El volumen de trading de Ethereum sube un 18%

El interés renovado por Ethereum se refleja también en su volumen de negociación, que aumentó un 18% para situarse en los $28 mil millones en tan solo 24 horas. Este aumento repentino en la actividad comercial suele interpretarse como una señal de que grandes jugadores están tomando posiciones antes de un movimiento más amplio.

Este tipo de comportamiento no es nuevo. Históricamente, los movimientos de las ballenas preceden a cambios importantes en el precio, ya sea por compras estratégicas en zonas de soporte o ventas masivas en niveles de resistencia.

Análisis técnico de Ethereum: ¿Un repunte sostenible?

Actualmente, Ethereum cuenta con una capitalización de mercado de $290.86 mil millones y cotiza en torno a los $2.409. Desde una perspectiva técnica, el RSI ha subido a 48 tras haber estado cerca de la zona de sobreventa. Esto apunta a un sentimiento de mercado que está pasando de neutral a alcista.

Las Bandas de Bollinger también indican que ETH está intentando salir de condiciones de sobreventa y aproximándose a la media de 20 días. Si el precio logra cerrar por encima de los $2.800, podría allanar el camino hacia el nivel psicológico de $3.000.

El MACD, por su parte, sigue en territorio bajista, aunque la línea MACD se está acercando a la línea de señal, lo que podría derivar en un cruce alcista si la tendencia continua. Sin embargo, el soporte clave a corto plazo es de $2.350; perderlo podría desencadenar una caída hacia los $2.100.

TE PUEDE INTERESAR: SharpLink Gaming apuesta fuerte por Ethereum con una inversión de $463 millones y redefine su estrategia empresarial

Análisis fundamental: Ethereum se fortalece más allá del precio

Si bien la atención está centrada en el precio de ETH, los fundamentos de la red también ofrecen una narrativa positiva. El aumento de la actividad institucional, la acumulación de ballenas y el crecimiento constante del ecosistema DeFi sobre Ethereum están consolidando su posición como la blockchain líder en contratos inteligentes.

Además, con la inminente llegada de los ETF de Ethereum al contado y mejoras como la implementación de proto-danksharding (EIP-4844), muchos analistas consideran que ETH está infravalorado en relación a su potencial a largo plazo.

Expertos opinan: ETH podría superar los $3.000 pronto

Analistas como Mister Crypto y Christiaan han compartido en la red social X (anteriormente Twitter) su optimismo respecto a ETH. Mister Crypto asegura que Ethereum está consolidándose dentro de un patrón de cinco años que podría dar paso a un rompimiento alcista significativo. Christiaan, por su parte, pronostica un aumento hasta los $3.000 en el mediano plazo, lo que representaría una ganancia de aproximadamente 25% desde los niveles actuales.

Esta opinión es respaldada por datos on-chain que muestran un descenso en los saldos de ETH en exchanges, una métrica que tradicionalmente sugiere acumulación y disminución de presión vendedora.

Ethereum sigue un 50% por debajo de su máximo histórico

A pesar del impulso reciente, Ethereum aún se encuentra un 50% por debajo de su máximo histórico de $4.891 alcanzado en noviembre de 2021. Esta distancia podría representar una oportunidad de entrada para inversores que creen en su potencial a largo plazo.

La combinación de acumulación por parte de grandes jugadores, mejora de los indicadores técnicos y fundamentos sólidos podría ser la antesala de un ciclo alcista.

TE PUEDE INTERESAR: Ethereum lanza decenas de oportunidades laborales remotas con salarios en dólares: Así puedes postularte

Conclusión: ¿Es Ethereum la próxima gran oportunidad?

La reciente alza del 7% en el precio de Ethereum, combinada con un incremento del 18% en su volumen de negociación y actividad inusual de ballenas, ha puesto a ETH nuevamente en el radar de inversores institucionales y minoristas.

Si la criptomoneda logra mantener su soporte clave y confirmar señales técnicas positivas, podríamos estar al inicio de un rally significativo. En un contexto de adopción creciente, innovaciones tecnológicas y movimientos de capital estratégicos, Ethereum podría consolidarse como uno de los activos más prometedores de 2025 y más allá.

Link del artículo original

Si el presente artículo, video o foto intrigue cualquier derecho de autor por favor señálelo al correo del autor o en la caja de comentarios.